Running a business requires more than just passion of 12 month profit and loss projection example pdf; it demands careful planning and foresight. One essential tool that every entrepreneur should have in their arsenal is a profit and loss projection. A well-crafted 12 month profit and loss projection example pdf can be your roadmap to navigating the financial landscape of your business.

Whether you’re launching a startup or managing an established company, understanding where your revenue will come from and how expenses will impact your bottom line is crucial. This guide aims to demystify the process of creating these projections, providing you with valuable insights into the importance of forecasting for future success. Let’s dive into what makes a solid profit and loss projection so vital for any business owner.

Importance of a 12 Month Projection

A 12-month profit and loss projection serves as a roadmap for any business. It outlines expected income and expenses, helping you plan effectively for the future.

By anticipating financial trends, businesses can make informed decisions about spending, investments, and growth strategies. This foresight is crucial in navigating challenges that may arise throughout the year.

Additionally, having a clear projection aids in securing funding or attracting investors. Financial backers often look for well-structured plans that demonstrate profitability potential.

Moreover, tracking actual performance against these projections allows companies to identify deviations early on. Adjustments can be made promptly to stay on target with financial goals.

This proactive approach not only enhances strategic planning but also bolsters confidence among stakeholders by showing a commitment to sound financial management.

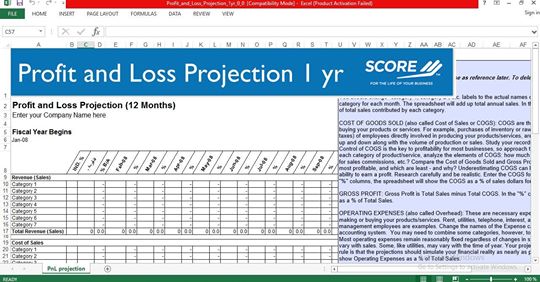

Components of a Profit and Loss Projection

Crafting a profit and loss projection involves several key components. Each element plays a vital role in providing a clear financial picture.

First is revenue, which details expected income from sales or services. This section often includes projections for different products or service lines.

Next comes the cost of goods sold (COGS). This refers to direct costs tied to producing your goods or delivering services. Calculating COGS accurately helps in understanding gross profit margins.

Operating expenses are another essential component. These include salaries, rent, utilities, and other overhead costs necessary to keep the business running smoothly.

Don’t forget taxes. Estimating tax liabilities ensures that your net income reflects real-world obligations.

Consider interest expenses if you have loans or credit arrangements. Including all these components provides a comprehensive view of financial health over the projected period.

Step-by-Step Guide to Creating a 12 Month Profit and Loss Projection

Creating a 12 month profit and loss projection can seem daunting, but breaking it down into manageable steps makes it easier.

Start by gathering your historical financial data. This includes past revenue, expenses, and any seasonal trends you’ve observed. Understanding where you’ve been helps predict where you’re going.

Next, outline your projected income sources. Consider product sales, services rendered, or any other revenue streams expected in the upcoming year.

Then move on to estimating your expenses. List fixed costs like rent and utilities alongside variable costs such as marketing or supplies. Be thorough; every dollar counts.

Once you have both income and expense estimates ready, build a monthly breakdown. This allows for adjustments based on seasonality or business changes throughout the year.

Review and adjust your projections regularly as conditions change in the market or within your business operations. Flexibility is key to maintaining accuracy over time.

Tips for Accurate Projections

Accurate projections are vital for a successful profit and loss statement. Start by gathering historical data. Past performance serves as a reliable foundation for your forecasts.

Engage with your team to gain insights from different perspectives. Their experiences can help refine assumptions about sales, costs, and market trends.

Regularly update your projections as new information arises. This flexibility allows you to adapt quickly to changing circumstances, ensuring that your outlook remains relevant.

Utilize industry benchmarks to gauge where you stand compared to competitors. These standards provide context and can reveal areas needing improvement or investment.

Don’t shy away from conservative estimates. Overly optimistic predictions can lead to disappointment later on; it’s better to underpromise and overdeliver when it comes time to evaluate performance against expectations.

Common Mistakes to Avoid

One of the most common mistakes in creating a 12-month profit and loss projection is underestimating expenses. Many businesses focus on expected revenues but neglect to account for all costs, leading to unrealistic forecasts.

Another pitfall is failing to update projections regularly. Business environments change rapidly; if you don’t revisit your figures periodically, you could miss key insights that impact financial health.

Relying solely on past performance can also be misleading. Trends shift, so it’s crucial to incorporate market research and industry benchmarks into your projections.

Overlooking seasonality can skew results significantly. If your business has seasonal fluctuations, ignoring them may lead to over-optimistic revenue expectations during slower months.

Being mindful of these mistakes will enhance the accuracy and reliability of your profit and loss projection.

Utilizing the Projection for Business Planning and Decision Making

A 12-month profit and loss projection is more than just a financial document; it’s a strategic tool that shapes your business decisions. By analyzing projected revenues and expenses, you can identify trends early on.

This foresight enables effective budgeting. You can allocate resources to high-performing areas while trimming costs in less profitable sectors. This proactive approach helps ensure sustained growth.

Moreover, these projections serve as an excellent communication tool with stakeholders. Investors appreciate transparency regarding potential earnings and risks involved. A well-structured projection builds trust and confidence in your leadership.

In times of uncertainty, revisiting your profit and loss projections allows for agile responses to market changes. Adjusting strategies based on updated data ensures you remain competitive amidst evolving dynamics.

Utilizing this projection effectively empowers informed decision-making that aligns with long-term objectives, ultimately driving the success of your business initiatives.

Conclusion of 12 month profit and loss projection example pdf

Creating a 12 month profit and loss projection is not just an exercise in numbers; it’s a crucial tool for understanding your business’s financial health. A well-structured projection helps you anticipate revenue, manage expenses, and make informed decisions that drive growth.

Armed with the right components, steps, and insights into common pitfalls, anyone can craft a meaningful projection. Remember to regularly revisit and adjust your projections as needed. This adaptability will ensure that your business remains resilient against changing circumstances.

Utilizing this document effectively can lead to better planning and more strategic decision-making down the line. Whether you’re seeking funding or simply aiming for clarity within your operations, having a solid 12 month profit and loss projection example pdf at hand will serve you well on your journey toward success.